-

-

Activities

of the group - The most important events in 2017

- Enea Group in numbers

- Letter from the President of the Board

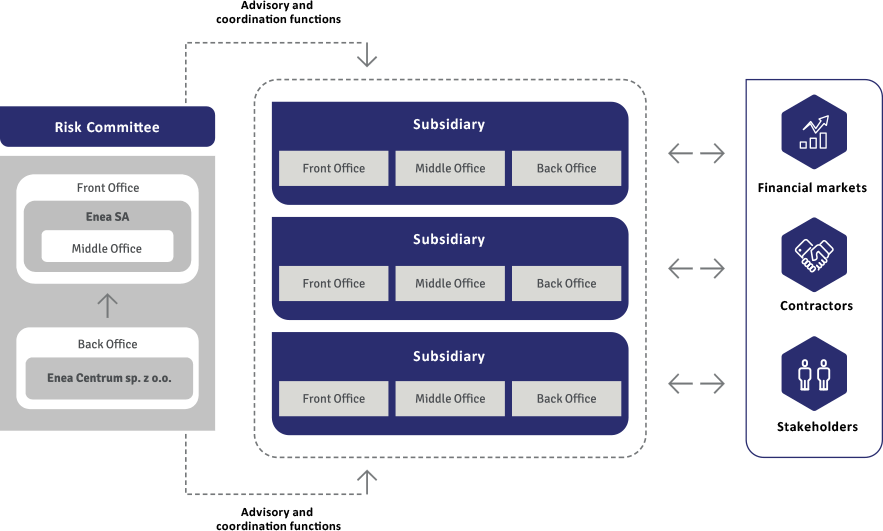

- Structure of Enea Group

- Changes in the group's structure

- Segments

- Agreements concluded

- Macroeconomic situation

- Description of the industry

- The situation on the electricity market

- Events that may affect future results

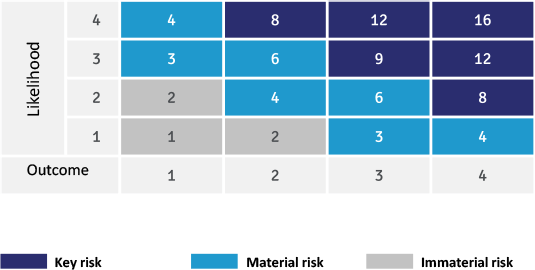

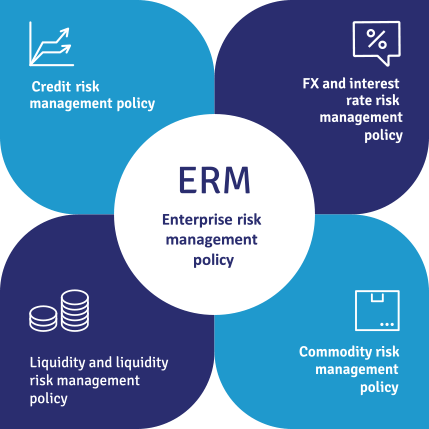

- Risk management

- Natural environment

- Employment

-

-

-

Investors

- Shareholder structure

- Quotations

-

Corporate governance

- The Management Board

- Declaration of the corporate governance application

-

Group Activity

We build a strong and innovative raw materials and energy group.

-

Activities

of the group - The most important events in 2017

- Enea Group in numbers

- Letter from the President of the Board

- Structure of Enea Group

- Changes in the group's structure

- Segments

- Agreements concluded

- Macroeconomic situation

- Description of the industry

- The situation on the electricity market

- Events that may affect future results

- Risk management

- Natural environment

- Employment